UK Plugin EV Share Above 23% In October, Up 1.9x YoY

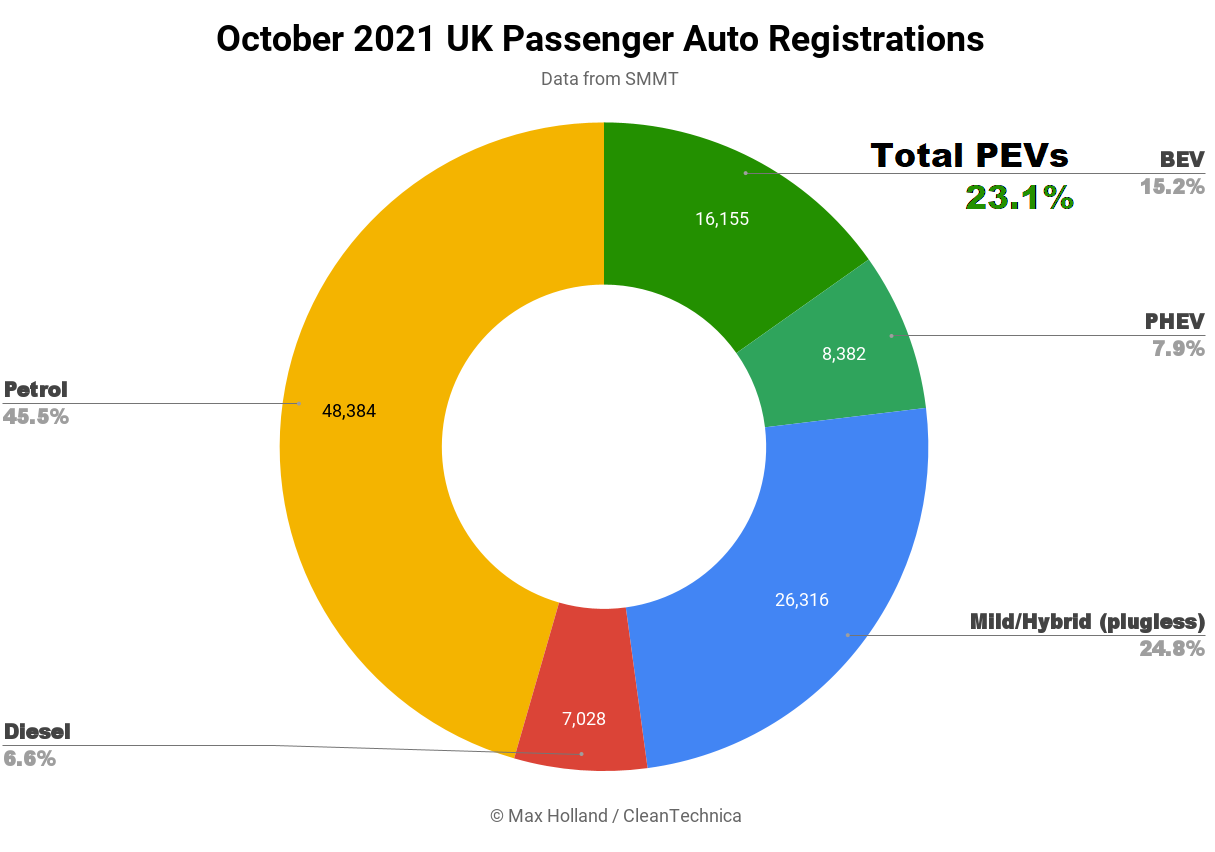

The UK, Europe’s third largest auto market, saw plugin electric vehicle share hit a new high of 23.1% in October, up 1.9x year-on-year, with two thirds of plugin share coming from full electrics. October’s overall auto market volume was down almost 25% from last year, at the lowest level since 1991. Kia took the largest portion (10.5%) of the full electric market in October.

October’s combined plugin share of 23.1% comprised mostly full battery electrics, at 15.2%, with plugin hybrids (PHEVs) taking at 7.9%. This roughly two-thirds weighting towards BEVs represents a continuing shift from the more even weighting of a couple of years ago.

Cumulative plugin share for 2021 now stands at 16.6%, from 9.1% by this point a year ago. Cumulative share should reach over 20% by the end of the year. The UK SMMT now expects 2021 full year auto volumes to end up giving 2% growth over 2020, at 1.66 million units. This would still represent a drop of 28% over 2019’s result (2.3 million).

Diesel share remained well below 10%, where is has now been since March, and will continue to fade away. Petrol share has hidden behind diesel over the past 12 months, only dropping from 49.5% to 45.5%, but once diesel is gone, Petrol will take face the full force of rising demand for plugins.

Will mild and full hybrids (blue band in below graph) help out in keeping plugins rise away from petrol? Apparently not much; their share peaked in July and August and has receded since. It may be that Toyota’s encouragement of magical thinking around “self charging” cars is running out of hot air.

Popular BEV Brands in October

As usual, we have sales data on monthly brand share of the UK’s BEV market from the UK DVLA, via New Automotive. The data excludes vehicles with custom license plates, but is proportionally indicative of the broader market.

Kia took the largest share in October, with 1699 units, thanks to a timely shipment from Korea, including 369 units of the new Kia EV6, according to a statement their UK CEO made to CarsUK.

Beyond just the monthly result, since Tesla (and Kia, MG and a few others) have irregular shipping schedules, let’s look at the trailing 3 months of BEV share, up to the end of October, to get a clearer picture of which brands are currently doing well in the UK:

Tesla obviously has a strong lead, thanks to the continuing popularity of the Tesla Model 3. This lead will only grow when the Model Y arrives in the UK in “early 2022” (according to Tesla’s current estimate).

BMW, a popular brand in the UK’s general auto market, will be hoping to climb these ranks in the coming months thanks to the new iX and i4 arriving. MG will be launching the Marvel R also in the coming months, hoping to build on the success of the MG ZS with a larger sibling.

If we step back further to look at automotive group performance over the trailing 3 months, VW Group maintains a slight lead over Tesla, and both are some way ahead of Hyundai Motor Group, and Stellantis:

Nissan Renault are doing poorly, relative to their early lead in the BEV market in Europe, and especially considering the fact that Nissan still makes the early pioneer LEAF inside the UK. This fall from grace demonstrates the cost of not innovating fast enough.

Outlook

The UK plugin market is doing well despite not yet receiving one of Europe’s hottest new models, the Tesla Model Y, and seeing some delays from other new models, due to being a RHD market.

Now that October has delivered above 23% share for plugins, what progress can we expect for the remainder of the year? For each of the past 5 years, December has been the peak month for plugin share, and we can expect to see that again in 2021.

We should now be looking for a result above 25% in November, and potentially above 30% in December. What do you think? Please share your take on the UK market in the comments below.